Q1 Letter: A Measured Life

- Greg Wait

- May 5, 2017

- 7 min read

On March 25th, while sipping iced tea after lunch with my lovely wife, Jodi, at an outdoor patio overlooking a marina on Hilton Head Island on a glorious day, I experienced cardiac arrest. In reading the medical report, the words “sudden cardiac death” are written as the descriptor of my event. With that event, a series of amazing people, previously unknown, came into my life. John Martin and Beth McDonnell, who I now call my guardian angels, saw the commotion and immediately administered CPR to bring me back to life. In less than ten minutes, a specially-trained “pit crew” of 11 EMTs from the Hilton Head Fire & Rescue arrived on the scene as my heart stopped again and brought me back to life. In short order, I was taken to the Hilton Head Hospital, where my heart stopped and was revived for a third time before receiving an emergency procedure in the cardiac cath lab from an excellent and caring team of medical professionals.

I now have a souvenir pacemaker/defibrillator from Hilton Head Island implanted in my chest! A strange, but encouraging, twist to this story is that my heart is perfectly healthy (I’ve worked hard at this, given a family history of heart disease). Rather than a classic heart attack, I experienced a rare electrical breakdown that could not have been anticipated in advance. I was told that the survival rate of this event is about 10%. Within a few days, I was able to personally meet and thank the incredible people who took action and allowed me to extend my journey here on Earth…

My amazing story illustrates the good inherent in people, and the well-wishes, support and prayers I’ve received have been overwhelming. Of course, perspective is so important when evaluating situations like this. This event does not frighten me, but rather encourages me spiritually and professionally. In their book, The Art of Possibility, Roz and Ben Zander describe a “world of measurement” in which the central position in our everyday life is held by assessments, scales, standards, grades, and comparisons. All manifestations of the world of measurement – the winning and losing, the gaining of acceptance and the threatened rejection, the raised hopes and the dash into despair – all are based on a single assumption that is hidden from our awareness…the assumption that life is about staying alive and surviving in a world of scarcity and peril. The Zanders suggest that, instead, we enter a universe of possibility that stretches beyond the world of measurement to include all worlds: infinite, generative, and abundant. In the measurement world, you set a goal and strive for it. In the universe of possibility, you set the context and let life unfold.1 One’s outlook is so important. Consider this old story:

A shoe factory sends two marketing scouts to a region of Africa to study the prospects for expanding business. One sends back a telegram saying, SITUATION HOPELESS…NO ONE WEARS SHOES The other writes back triumphantly, GLORIOUS BUSINESS OPPORTUNITY…THEY HAVE NO SHOES2

My profession is based on the measurement, analysis and evaluation of the risks and returns of investment portfolios. Over the years, I’ve come to realize that investment consultants often measure things that are unimportant to most clients, and sometimes irrelevant to good portfolio management. Worse, investors typically focus on performance measurement for periods that are far too short to be meaningful or statistically significant. Consider the following risk/return charts, reflecting the net rate of return on the vertical axis and standard deviation – a measurement of risk/volatility – on the horizontal axis, of a sample portfolio of three actively-managed mutual funds: global equities fund (75%), core fixed income fund (20%), money market fund (5%). We used no special evaluation criteria in the selection of these funds, other than they had to have a track record of at least 40 years. The sample portfolio is plotted on the chart relative to the S&P 500 Index for comparison.

3-YEAR PERIOD – probably not the risk/return tradeoff an investor would seek.

CURRENT BULL MARKET (nearly 8 years) – good absolute numbers, but still not the risk/return tradeoff one would seek. By the way, the S&P 500 Index has been the best performing index in the world over this period of time…not always the case!

10-YEAR PERIOD – an acceptable risk/return tradeoff.

20-YEAR PERIOD – now we’re talkin’!

40-YEAR PERIOD – I’ll take this all day long!

It’s all a matter of perspective, isn’t it? Long-term investors who do not get too self-absorbed in comparing themselves to others or listening to the rants and raves of the so-called investment experts in the media, sleep well knowing that a well-conceived investment portfolio should allow them to achieve their financial objectives. With that behind them, they are free to break the chain of investment worry and live their lives in a fulfilling and meaningful way, according to the context they’ve imagined for themselves. I fully understand the irony of using measurement to illustrate the fallacies of measurement, but context is important.

My wish for all our clients is that you can live in a world of possibilities and not confine yourselves to the chains of measurement.

2017 Q1 Review

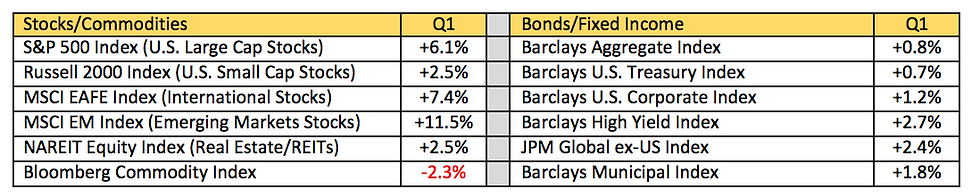

The first quarter of 2017 was remarkably calm and positive across nearly all major asset classes. The U.S. stock market finished the quarter in positive territory. Generally, large cap stocks earned more than small cap stocks and the growth style outperformed the value style…a reversal of 2016 results. The best performing sectors in the S&P 500 Index in Q1 included Technology (+12.6%), Health Care (+8.4%), and Consumer Discretionary (+8.4%). The worst performing sectors during the quarter were Energy (-6.7%), and Telecom (-4.0%).

Non-U.S. stocks, in both developed and emerging markets, rebounded strongly during Q1. During the quarter, the best performing countries included India (+17.1%), China (+12.9%), and Brazil (+10.4%). Countries whose stock markets delivered lower returns for U.S. investors included Russia (-4.6%), and Japan (+4.6%). The U.S. Dollar generally fell relative to most other currencies, increasing returns for U.S. investors in international stocks.

The bond markets also rebounded during the quarter as investors determined that the proposed inflationary policies of the new Administration may be more difficult to enact than anticipated. All broad bond markets delivered positive returns for the quarter. Cash (money market funds) yields continue on an upward path.

Hedging strategies generally delivered positive returns in the first quarter, with the HFRI Composite earning +2.2%.

Here are the returns for select market indices for Q1 2017 (as stated in U.S. Dollars):

Responsible Investing Corner

My recent experience brings even more clarity to my belief that human beings are called to love each other, to help those who are less fortunate, and to be good stewards of our beautiful planet. The power of private capital can be used to help fulfill this human call. Recently, the Ford Foundation announced that it will allocate up to $1 billion of their endowment to mission-based investments (MRIs). You may know that US tax law requires that foundations pay out a minimum of 5% of their assets to charities each year. The other 95% of foundation assets are invested with the goal of growing assets so that additional charitable donations can be made in future years. After conducting diligent research, the Ford Foundation has come to the conclusion (as I have) that they can make impactful investments and achieve an attractive rate of return on assets. Consistent with their mission, the Ford Foundation hopes to make diversity, equity and inclusion bywords of this investment movement. They are joining a growing number of endowments, pension funds, universities and other institutional investors in recognizing how they can have a powerful impact on society. Darren Walker, President of the Ford Foundation, says “If philanthropy’s past half century was about optimizing the 5 percent, its next half century will be about beginning to harness the 95 percent as well, carefully and creatively.”3

Prophecy Impact Investments, LLC is designed for anyone, regardless of the size of their investment portfolio, who is interested in generating a good rate of return while helping to make the world a better place. Our Sustainable Portfolios continue to perform very much in line with our expectations on a risk-adjusted return basis. As you may know, our sister company, Falcons Rock Investment Counsel, serves a select client base and we have successfully transitioned tens of millions of dollars to investment strategies that incorporate Environmental, Social and Governance (ESG) criteria. Sustainable, Responsible and Impact (SRI) investing is becoming widely accepted for the “double bottom-line” it delivers. I would appreciate you spreading the word about Prophecy, and the good work we are doing at both of our firms.

This and That

The U.S. household debt service ratio (debt payments as % of disposable personal income) is 10.0%...the lowest level on record.4

In recent years, the U.S. economy has been described as a “healthy tortoise”…slow but steady growth. The global economy has been described as a “hare on a lunch break”…lots of potential for growth, but a stubborn unwillingness to achieve it. The lunch break appears to be over, as global growth is at its fastest pace in the past five years.5

If you have been thinking about updating your estate plan or your life insurance policies, let my story serve as a reminder to do it now! I updated my life insurance policies about a year ago at super-preferred rates…that would not be the case today.

Baseball season is upon us…the Brewers home opener was last week and the Cubs celebrated the raising of their World Series Champions flag at their home opener this week. Play Ball!

“The years ahead will occasionally deliver major market declines – even panics – that will affect virtually all stocks. No one can tell you when these traumas will occur. During such scary periods, you should never forget two things: First, widespread fear is your friend as an investor, because it serves up bargain prices. Personal fear is your enemy.” – Warren Buffett

My father passed away last fall, and his favorite song was the Frank Sinatra classic “That’s Life.” It was played at his funeral (along with the Go, Cubs Go song!) and many folks sang along. It’s a song about perseverance and attitude, including this excerpt:

Each time I find myself flat on my face I pick myself up and get back in the race

I’m in!

Thank you for being a client…it is a privilege to serve you.

Gregory D. Wait, President Prophecy Impact Investments, LLC

__________________________________________________________________________________________ 1 The Art of Possibility by Rosamund and Benjamin Zander 2 The Art of Possibility by Rosamund and Benjamin Zander 3 Ford Foundation – Unleashing the power of endowments: The next great challenge for philanthropy – April 5, 2017 4 JPMorgan Asset Management: Guide to the Markets – March 31, 2017 5 JPMorgan Asset Management Guide to the Markets – Manufacturing Momentum – March 31, 2017

Comments